Maclear.ch is a Swiss-based Peer-to-Peer (P2P) crowdlending platform launched around 2023. It connects investors with Small and Medium-sized Enterprises (SMEs) across Europe (and beyond) seeking funding.

- The Appeal: It offers very high returns (13% – 15% APY), which is above the industry average for secured business loans. It markets heavily on its “Swiss” reliability.

- The Catch: It is a young platform with a limited track record. While it boasts a “Provision Fund” and Swiss regulation, independent analysts have raised serious concerns about transparency and the accuracy of borrower financial data.

Platform Basics

| Feature | Details |

| Annual Return | ~12% – 15% |

| Loan Type | SME Business Loans (Crowdlending) |

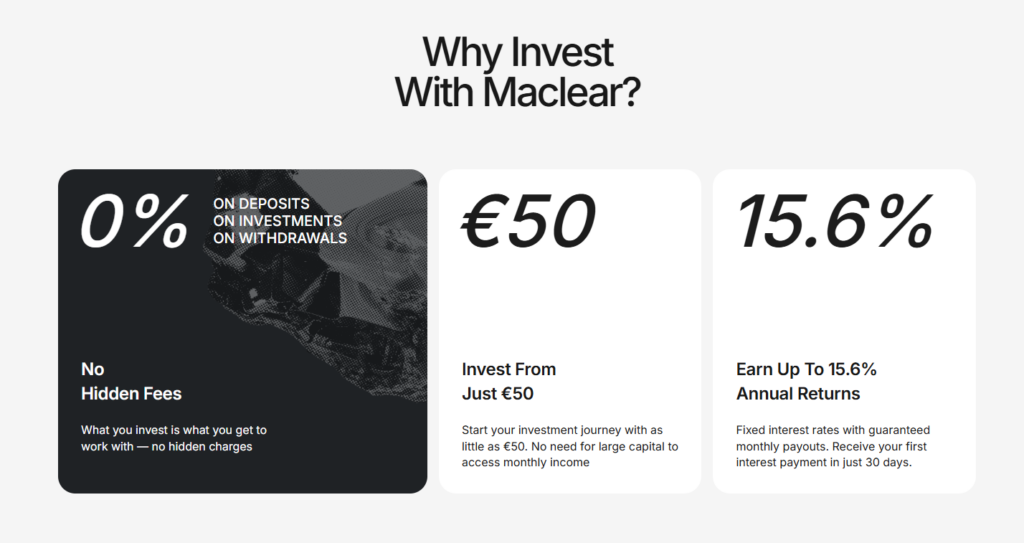

| Minimum Investment | €50 |

| Fees | 0% for investors |

| Regulation | Member of PolyReg (Swiss Self-Regulatory Organization) |

| Protection | Asset-backed loans + Provision Fund |

| Secondary Market | No (Limited liquidity) |

| Auto-Invest | No (Manual investing only) |

How It Works

Maclear operates as a classic crowdlending marketplace.

- Borrowers (companies in construction, agriculture, technology, etc.) apply for loans.

- Maclear performs due diligence, assigns a risk score, and lists the project.

- Investors (you) lend money to these projects in chunks as small as €50.

- Repayment: You receive monthly interest payments and the principal at the end of the term.

The Good (Pros)

- High Yields: Returns of 14-15% are excellent. In the current European P2P market, established competitors (like PeerBerry or Debitum) typically offer 9-11% for business loans.

- Swiss “Seal of Quality”: The platform is registered in Switzerland, a jurisdiction associated with financial stability. It adheres to Swiss AML (Anti-Money Laundering) laws via PolyReg.

- Provision Fund: Maclear sets aside ~2% of funded project amounts into a separate fund. This is designed to cover payments if a borrower defaults. (Note: This is discretionary and not an insurance policy).

- User Experience: The interface is modern, clean, and easy to navigate.

- Zero Fees: There are currently no deposit, withdrawal, or investment fees for users.

The Bad & The Risky (Cons)

- Regulation Misconception: While “Swiss Regulated” sounds ironclad, Maclear is not a bank. Its membership in PolyReg primarily ensures they check for Money Laundering (AML/KYC). It does not mean the Swiss government audits the quality of their loans or guarantees your capital.

- Transparency Issues (Red Flag): Deep-dive analyses by third-party auditors (such as P2P Empire) have found discrepancies in borrower data. For example, some borrower companies listed on Maclear showed high revenues in the platform’s description, while official local tax registries showed those same companies had zero revenue or were operating at a loss.

- Lack of Liquidity: There is currently no secondary market. If you invest in a 12-month loan, your money is locked for 12 months. You cannot exit early if you need cash.

- Short Track Record: The platform is very young (operating since 2023). It has not yet weathered a full economic cycle or a wave of defaults.

- Marketing Tactics: There have been allegations of aggressive marketing, including bot-like positive comments on forums and review sites, which can distort the true user sentiment.

In-Depth Risk Analysis

1. Is my money safe? Not 100%. P2P lending is high-risk. If a borrower defaults, Maclear tries to recover funds by selling the collateral (machinery, real estate, etc.). If the collateral value crashes, you lose money.

- The Provision Fund: This helps with short-term delays, but it is too small to cover a mass default event.

2. Who are the borrowers? Maclear lends to companies in various jurisdictions (Estonia, Switzerland, etc.). The concern raised by analysts is that some of these borrowers appear to be “shell” companies or have financial health that is weaker than advertised.

3. Financial Stability of the Platform As a startup, Maclear is likely burning cash to grow. In the unlikely event that Maclear itself goes bankrupt, an external liquidator would handle the loan book. However, this process is messy and often results in capital loss for investors.

Verdict: Is Maclear Worth It?

Rating: 3.5 / 5 (High Risk / High Reward)

Maclear is best suited for experienced P2P investors with a high risk tolerance who are chasing maximum yield.

- Invest IF: You want to diversify a small portion of your portfolio into high-yield business loans and are willing to accept the risk of a new platform in exchange for 14%+ returns.

- Avoid IF: You require immediate liquidity (access to your cash), you are risk-averse, or you prefer platforms with audited track records (like Monefit, PeerBerry, or Esketit).

Recommendation: If you choose to invest, treat it as a “speculative” slice of your portfolio. Do not allocate more than 5-10% of your total P2P budget here until the platform proves its transparency and borrower quality over a longer period (2-3 years).

Disclaimer: This blog post is for informational purposes only and does not constitute financial or investment advice. All investments carry risk, including the potential loss of principal. You should consult with a qualified financial professional before making any investment decisions.

Discuss this article / 0 comments