Monefit SmartSaver is an investment platform that entered the market in late 2022, serving as a new channel for retail investors to participate in peer-to-peer (P2P) financing. The product is owned and operated by the Creditstar Group, a European fintech company that has been profitable since its founding in 2006. Creditstar Group, headquartered in Estonia and regulated as a lender in eight European countries, provides consumer credit services.

The primary function of Monefit SmartSaver is to attract retail investor capital, which is then allocated to a carefully vetted portfolio of consumer loans originated by Creditstar. This funding mechanism provides the parent company with an additional, lower-cost source of capital, which supports the expansion of its lending services and diversifies its funding channels beyond traditional institutional debt markets. The platform’s marketing emphasizes simplicity and accessibility, positioning it as an ideal entry point for first-time investors while also offering a straightforward diversification tool for seasoned professionals.

The Investment Proposition: Simplicity and High Yield

The central appeal of Monefit SmartSaver is its combination of a completely passive investment model with a high, fixed rate of return. Unlike traditional P2P lending platforms where investors must manually select individual loans, Monefit uses a “set it and forget it” approach. Once funds are deposited, they are automatically invested and managed by the platform, removing the need for investors to monitor their portfolios or make complex decisions.

The advertised returns are a major draw, especially when contrasted with the anemic interest rates offered by traditional European bank accounts. For instance, high-yield savings accounts from major banks in Estonia offer rates of only 1.75% to 2.5%, which are insufficient to combat the effects of high inflation. In this context, Monefit’s returns, which have been reported at 7.25% and recently increased to 7.5% for the standard product, offer a seemingly powerful alternative to make “money work harder”.

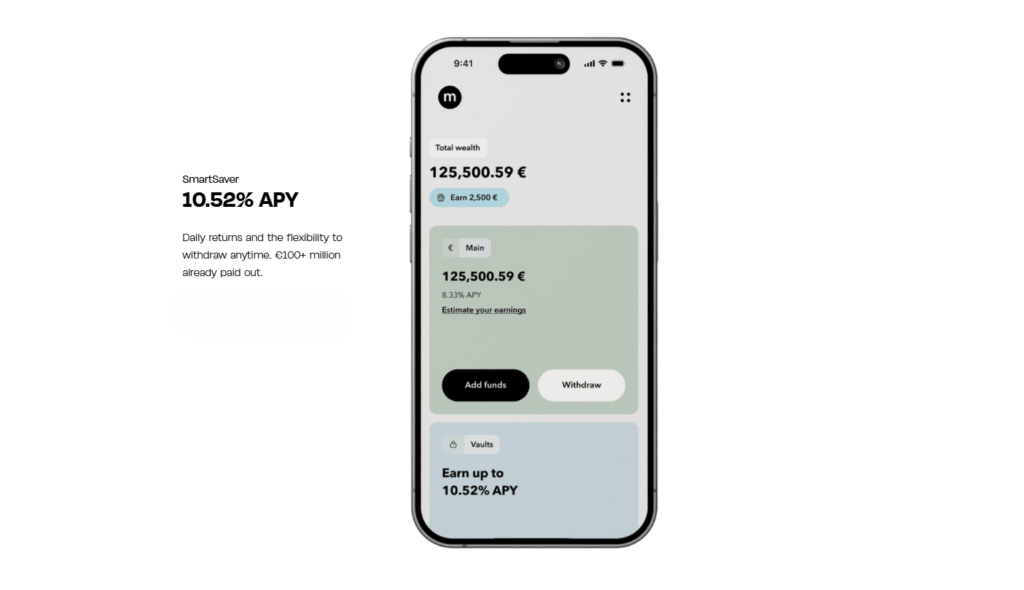

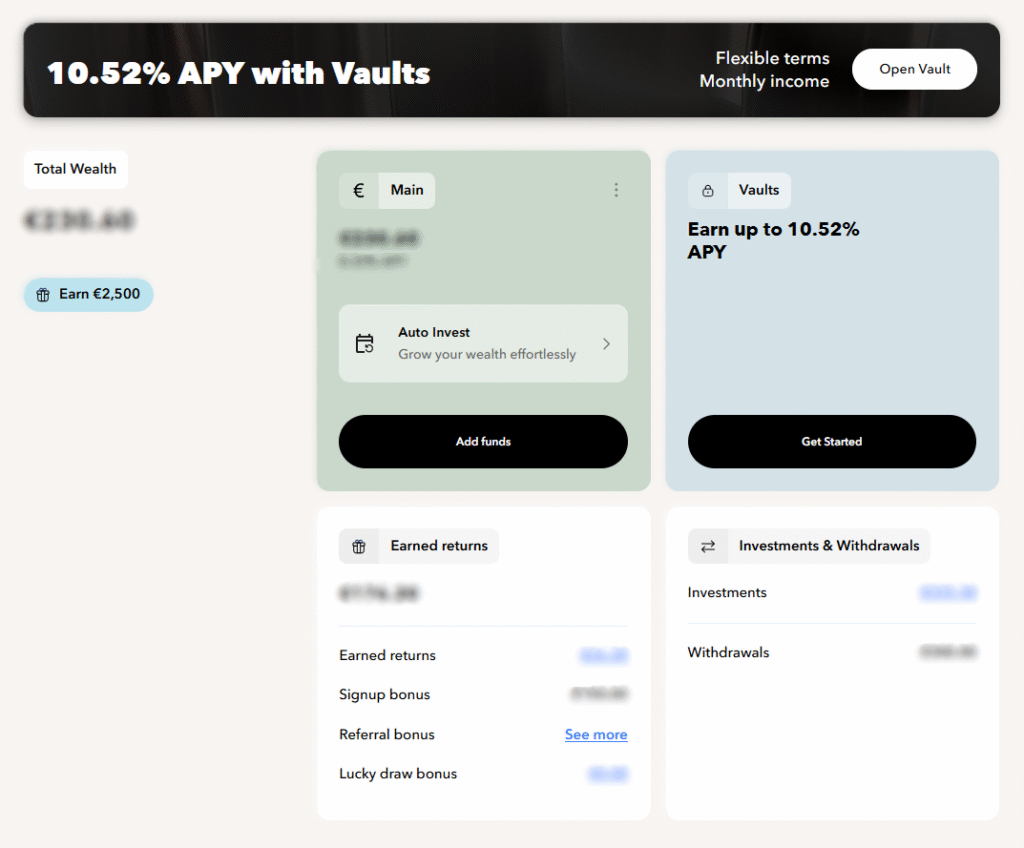

A Dual-Product Offering: Main vs. Vaults

- Main: This product is designed for high liquidity. Its fixed annual interest rate has been subject to change, with various sources reporting different figures. While some older sources mention a 7.25% rate, more recent reports indicate an increase to 7.5%. This dynamic rate structure suggests the company adjusts its offering based on market conditions to maintain a competitive advantage, particularly against its primary rival, Bondora Go & Grow.

- SmartSaver Vaults: Introduced in March 2024, the Vaults product functions similarly to a fixed-term deposit. It rewards investors with higher yields in exchange for a longer commitment period. The tiered structure offers progressively higher returns for longer lock-up periods: 8.33% APY for a 6-month term, 9.42% for 12 months, and up to 10.52% for a 24-month commitment.

The following table provides a clear overview of the key features and rates for both products, synthesizing the information from various sources to resolve the conflicting data points.

| Product Type | Interest Rate (APY) | Term | Liquidity | Minimum Investment |

| Main account | 7.5% | No fixed term | Withdrawals within 10 business days | 10 € |

| Vault (6-month) | 8.33% | Fixed 6 months | Fixed-term | 100 € |

| Vault (12-month) | 9.42% | Fixed 12 months | Fixed-term | 100 € |

| Vault (18-month) | 9.96% | Fixed 18 months | Fixed-term | 100 € |

| Vault (24-month) | 10.52% | Fixed 24 months | Fixed-term | 100 € |

Operational Mechanics and User Experience

Monefit SmartSaver distinguishes itself from traditional P2P lending platforms by removing all investor decision-making. The platform’s automated system handles the allocation of funds to the underlying loan portfolio of the Creditstar Group. This feature is a core component of its appeal, as it provides a simple and effortless way to earn passive income. The model is particularly attractive to investors who lack the time or expertise to manage a diversified portfolio of individual loans, a requirement on many other platforms.

User Journey: From Sign-up to Withdrawal

The user experience is designed for simplicity. The registration process is promoted as fast and easy, with many users reporting completion in under five minutes, including ID verification. To qualify for an account, an individual must be at least 18 years old and have a personal bank account within the European Economic Area or Switzerland, and they must pass an identity verification process.

The platform accommodates a wide range of investment amounts, from a minimum of 10 euros for the standard account to a maximum of 500,000 euros. Deposits can be made via bank transfer or card, with funds generating interest immediately upon investment.

Recently, Monefit introduced Auto Invest! After topping up your SmartSaver Main Account, keep an eye on the top corner — the Auto Invest button is right there, ready to help you grow your savings effortlessly.

Liquidity and Payouts: The Promise vs. The Reality

Monefit’s marketing language heavily emphasizes liquidity and continuous returns. The website advertises “Instant payment & easy withdrawal” and claims returns are “paid out every day”. The company also proudly highlights its “100% on-time payback history” since the product’s launch, and claims withdrawals are processed within 10 business days with no fees.

Independent reviews provide additional insights that complement the platform’s promotional messaging. Returns are calculated and credited daily, ensuring consistent growth. The platform also boasts a 100% on-time payout history during its operational period. While withdrawals are processed within up to 10 business days, this structured window helps maintain smooth and reliable fund management.

A Deep Dive into Creditstar Group

The platform’s stability is supported by the solid financial foundation and proven track record of its parent company, Creditstar Group.

Parent Company’s Financial Health and Track Record

Creditstar Group has been a profitable entity since its inception in 2006 and has a track record of consistent profitability over 18 years. The company’s financial reports indicate a profit of €7.2-7.3 million in 2024, a decline from the €10 million reported in 2023. This decline was attributed to a strategic transition to International Financial Reporting Standards (IFRS), which necessitated higher loan-loss provisions. The group also reported a substantial 27% expansion of its net loan book to €351.2 million and a 17% increase in total interest income to €74 million in 2024.

The business model appears robust. Creditstar charges high interest rates of 25-35% on its consumer loans, which provides a significant revenue buffer to cover the 7.5% interest paid to Monefit investors. The company also maintains a cash buffer of 15-20% to manage liquidity and ensure it can meet withdrawal requests.

Direct Rivalry: Monefit SmartSaver vs. Bondora Go & Grow

Monefit SmartSaver’s most direct and frequently cited competitor is Bondora’s Go & Grow product. Both platforms offer a similar value proposition: a simple, passive investment that provides high liquidity and fixed returns, targeting investors seeking an alternative to traditional savings accounts.

The primary competitive advantage for Monefit is its higher interest rate. While Bondora recently reduced its fixed rate from 6.75% to 6.0%, Monefit increased its rate to 7.5%, creating a significant 1.5% difference. Bondora, in response, has focused its marketing on security and its crisis-tested track record, having operated through multiple economic cycles. In contrast, Monefit focuses on profitability and higher returns for its customers. While Bondora’s platform is often considered more streamlined and user-friendly, Monefit’s superior interest rate, tiered Vaults, and a more robust bonus program are designed to attract investors who prioritize yield over all else.

P2P Marketplace Alternatives (e.g., PeerBerry, Lendermarket)

For investors comfortable with higher complexity, P2P marketplaces offer more diverse options. Lendermarket offers returns of up to 18%. However, this comes with the added complexity of manually selecting loans or using an auto-invest feature with specific criteria. Other platforms like PeerBerry and Viainvest offer investor protections. Viainvest, for example, is regulated by the central bank of Latvia and provides an investor compensation scheme up to 20,000 euros. PeerBerry provides a buyback guarantee and a group guarantee, providing double protection for investors.

Conclusion and Recommendations

The Monefit SmartSaver platform is a compelling product for its intended niche. Its key strengths are the combination of high fixed returns, a simple and automated investment process, and a user-friendly interface. The introduction of the tiered “Vaults” product offers investors more options for yield enhancement in exchange for reduced liquidity.

Final Perspective: Is Monefit SmartSaver a Worthwhile Investment?

For the specific investor profile that values simplicity, is well-versed in the risks, and is actively seeking high-yield opportunities to speculate with a small portion of their capital, Monefit SmartSaver can be a useful tool. The product is a testament to the continued innovation in the fintech space and its ability to offer an alternative to traditional financial products.

Discuss this article / 0 comments