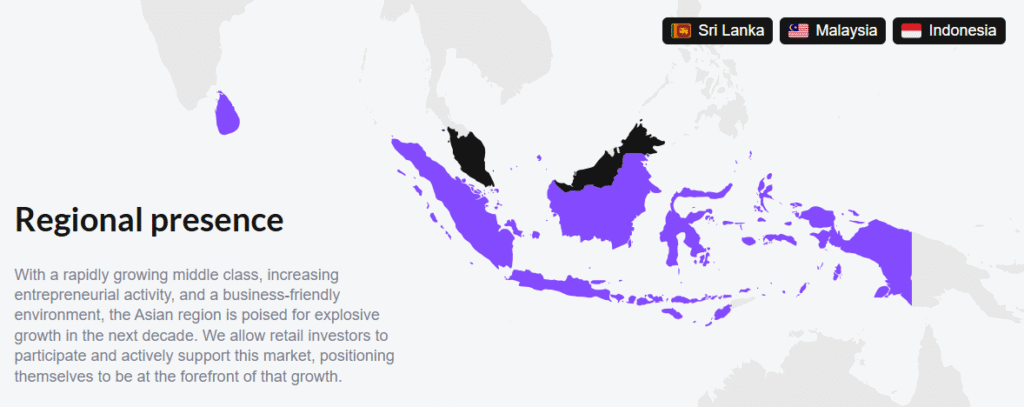

Loanch is a peer-to-peer (P2P) lending platform founded in Hungary in late 2022, offering investment opportunities in short-term consumer loans across emerging Southeast Asian markets like Indonesia, Malaysia, and Sri Lanka. It markets compelling interest rates of up to 13–16.6% APR, low entry barriers (as little as €10), no fees, and tools like auto-invest and loyalty bonuses.

Key Features at a Glance

- High Yields: Advertised returns range from 13% to 16.59%, positioning Loanch among higher-yielding P2P options.

- Buyback Guarantee: Loans are backed by a 30-day buyback guarantee—faster than the industry norm of 60 days—but effectiveness depends on the originator’s stability.

- Auto-Invest & Loyalty Program: Tools like auto-invest simplify deployment of funds, while new investors can earn up to 1% bonus interest through a loyalty program.

- Zero Fees: No hidden charges for registration, deposits, or withdrawals.

- Low Minimum Investment: You can start with just €10 per loan, making it accessible even for small-scale investors.

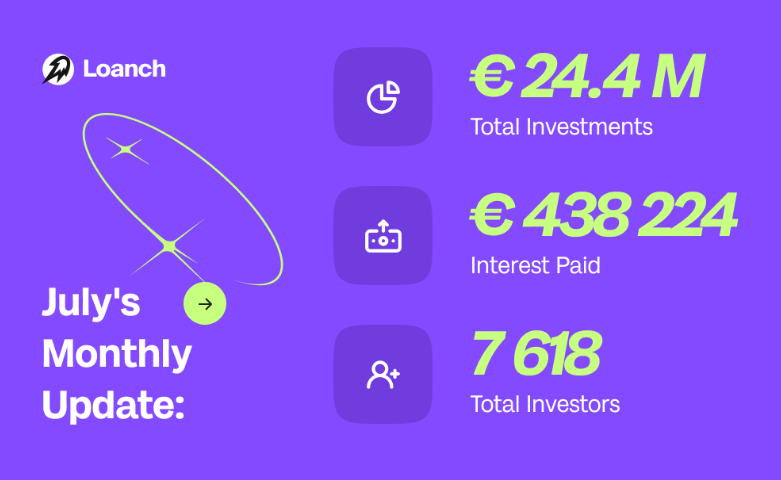

Platform Usage & Performance

- Growing Investment Volume: As of May 2025, Loanch had facilitated over €19 million in investments, with recent monthly volumes exceeding €1.3 million, indicating rapid growth.

- User Experience: Reviews praise the platform’s interface and auto-invest ease. Some early tests reported timely returns and working buyback provisions over a 3-month period.

Risks & Concerns

- Opaque Ownership Structure: A major red flag—reports suggest that Loanch and its loan originators (Ammana, Tambadana, Ceyloan) may be owned by the same parent company, Fingular, allegedly tied to an individual with prior P2P defaults. This consolidation heightens systemic risk if the parent falters.

- Regulatory & Transparency Issues: Loanch is unregulated and provides limited transparency regarding loan performance and ownership, making it difficult to assess long-term reliability.

- Mixed User Feedback: Trustpilot scores are moderate (~3.7/5), with praise for returns but criticism over customer service and limited diversification.

- Trustpilot (France) reviews cite active Telegram support but note delays in fund transfer and concerns about the founders’ past P2P performanceTrustpilot.

- Low Trust Ratings from Scam Detection Tools: Platforms like Scam Detector and ScamDoc assign Loanch a low-to-medium trust score (~45%) due to factors like hidden domain ownership and proximity to potentially suspicious websites.

Final Verdict

Loanch offers attractive returns, user-friendly tools, and rapid access to emerging Southeast Asian loan markets. For risk-tolerant investors, it may serve as a yield-enhancing option—but not without considerable reservations.

If you’re considering investing, ensure you:

- Conduct thorough due diligence, including on loan originators.

- View Loanch as a small part of a diversified investment portfolio.

- Avoid excessive reliance on its buyback guarantee due to concentrated counterparty risk.

In short—Loanch can deliver rewards, but the risks may outweigh them for more conservative investors.

Discuss this article / 0 comments