Monefit SmartSaver is taking returns to the next level with the launch of its new feature, the Vaults. These Vaults offer fixed-term deposits, providing investors with two options to maximize their returns. You can choose to lock in your funds for 6 months and enjoy a boosted return of 8.87% APY, or opt for a 12-month commitment with an impressive 9.96% APY return. The minimum investment required is 100 EUR. Keep in mind that during the chosen term, access to your funds will not be available, making it akin to a bond with Monefit.

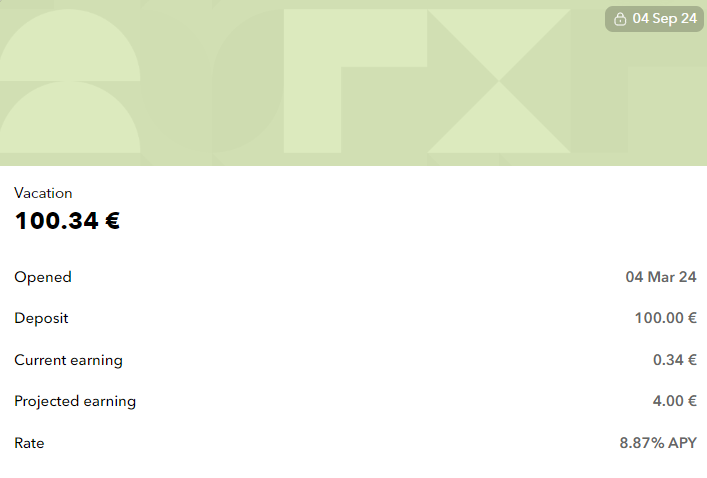

Last week, I tested this feature by investing 100 EUR from my existing portfolio, and I’ll be monitoring its performance over the next 6 months. It’s worth noting that while early withdrawals are possible according to the terms and conditions of the Monefit SmartSaver Vault, they come at the cost of forfeiting all accrued interest. Additionally, once a Vault is opened, there’s a 10-business-day window to top up the investment. After this period, a new Vault will need to be initiated. At the end of the term, you’ll receive your initial investment along with accrued interest, which accumulates daily within the Vault.

If you’re interested in learning more about this product, I recommend reading through my Monefit SmartSaver experiences, which provide essential background information to help you understand the associated risks and opportunities. Plus, for a limited time, there’s a 0.25% cashback offer for all investments made within the first 90 days, along with a 5 EUR starting credit.

Discuss this article / 0 comments