Bondora is an Estonian private loans platform (” Peer to peer lending “) founded in 2009 which offers the possibility of financing loans in Estonia, Finland and Spain. It is the second platform in Europe in terms of volumes and is currently supported by over 72,000 investors. Any European citizen can register and start investing with just 1 euro at average rates around 10.6% gross per annum.

Key Numbers

+ 72,500 active investors

+247 million euros collected

+ 10.6% average annual return (gross)

+ 0.5% default rate observed

Main features

Loan types: Consumer loans, business loans

Markets: Estonia, Spain, Finland

Duration: 3 months – 60 months

Interest rate range: 5 – 14% +

Minimum investment: 1 EUR

Currency: EUR

Secondary market: Yes

Self-investing: Yes

Buyback Guarantee: No

Regulated: Yes as a credit provider

Loanbook available: Yes

How Bondora works

Like all P2P lending platforms, Bondora performs the credit risk analysis of the applicants and for those who are positively valued, proposes them to investors within a marketplace. At this point users can decide to finance each individual subject, even by splitting the amount. Sharing funding involves sharing and reducing the risk that the borrower will not pay. In this way, any failure to pay an installment is divided over all investors who have contributed to the borrower’s financing.

Bondora’s business model is based on the revenue received by borrowers (Applicants). The investor, on the other hand, does not pay any commission, neither to deposit money, nor to invest it, nor to withdraw it. The money transferred to Bondora is kept in a segregated account in SEB Bank, a Scandinavian bank with a good rating.

How to invest in the platform?

Bondora was created to offer investment opportunities for a wide range of both novice investors and sophisticated investors. At present, the platform offers four investment methods that we will go through in detail.

Go & Grow

The Go & Grow product can be compared to a bank deposit account and is the most suitable product for novice investors. The initial settings are very simple. After assigning a name to your account, you need to define the initial amount you want to invest, any monthly deposits and the duration expressed in terms of years. At this point, the system automatically configures the investment strategy and will purchase the loans directly on the market. The expected return is 6.75% per annum gross paid daily. The system invests only in short-term loans and it is possible to liquidate one’s position at any time at a cost of 1 euro.

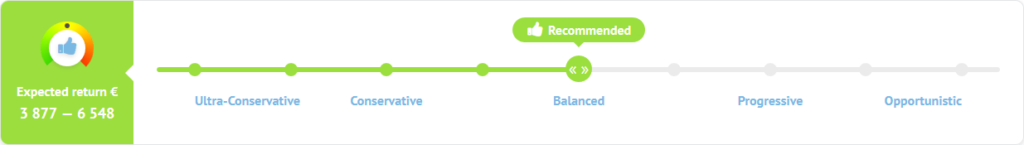

Portfolio manager

Portfolio manager is the second investment method, slightly more customizable than Go & Grow. This method is also recommended for novice investors or those who are not yet familiar with the instrument. Compared to the previous product, it is possible to decide the level of risk / return to which we are interested. The platform will automatically distribute the amounts to be invested in the various risk classes. The minimum amount is € 5. Portfolio Manager also deals with buying or reselling loans on the secondary market.

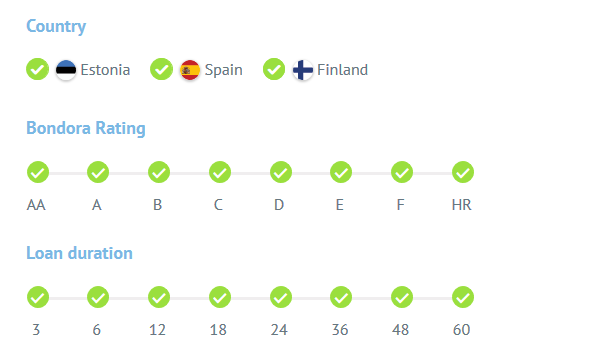

Portfolio PRO

The third investment method “Portfolio PRO” is the most suitable for experienced investors as it offers a large number of settings compared to the other two modes. At the beginning, as always, you will have to set your criteria, from that moment on; Portfolio Pro will independently take care of the investment process. The main criteria are: geography, risk classes, duration and maximum amount to invest on each individual loan. Bondora assigns each loan a default probability of payment assessment. The rating has eight levels ranging from “AA” (lower probability of default) to “HR” (greater probability of default).

API

The last mode of investment, used by 1% of investors, concerns the API (application programming interface) that allows those who have programming skills to create their own investment application. It is the most efficient mode as it allows you to build your own investment algorithm but highly complex to implement for those who are not familiar with programming.

Secondary market and liquidity

Bondora secondary market allows an early exit of an investment and recover the money before it expires. It is a very large and liquid market and offers the possibility of making extra profits by selling its loans at a premium. If you want to liquidate your positions almost instantly, you need to offer your investments at a discount especially for those that offer “uninteresting” returns. Positions are not always able to be liquidated in a short time, especially those with a rather low or late rating.

Conclusions

Bondora is the second platform in Europe in terms of volumes traded. Inside the website it is possible to download the entire loanbook of the platform since it was born. By analyzing the data in detail, numerous delays can be noticed, and most of them do not offer a buyback guarantee. Novice investors should not use advanced features as they may find themselves with some losses in their portfolio. For this kind of users, the best solution remains the Go & Grow product even if it offers a lower interest rate than the average market rate.

Discuss this article / 0 comments