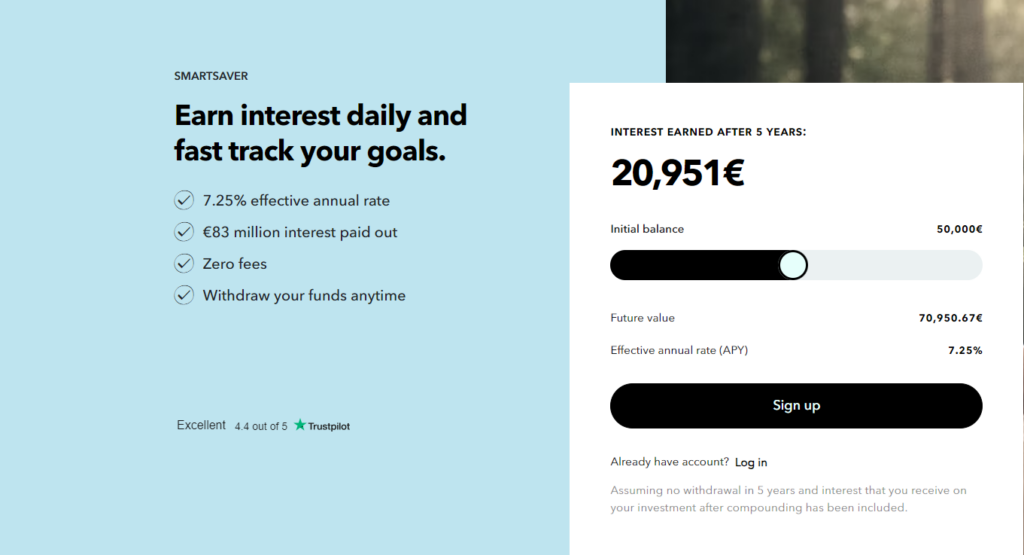

Monefit has just introduced a game-changer for retail and corporate investors in Europe – SmartSaver 7.25%. This innovative offering empowers individuals and businesses to make the most of their savings, providing a solid path towards achieving their financial goals.

Key Features of SmartSaver

- Steady 7.25% Effective Annual Rate (EAR): SmartSaver offers an attractive fixed interest rate, considerably more appealing than traditional savings accounts.

- Daily Interest Calculation: Your money is constantly working for you, accumulating compound interest daily.

- Flexibility: SmartSaver provides the freedom to withdraw your funds at any time without hassle.

- Zero Fees: Enjoy the full benefits of your savings with no hidden costs or fees.

- Accessible to All: You can begin your SmartSaver journey with as little as €10, making it accessible to everyone.

Why SmartSaver Matters

In an era of rising inflation, traditional savings can lose value over time. The aftermath of COVID-19 has seen an uptick in personal and disposable incomes, increasing the need for stable and higher-yielding products.

High street banks are often unable to offer competitive returns, and alternative investment models struggle to provide meaningful returns. Many savings products driven by investment instruments are tailored to institutions, leaving individual investors missing out on lucrative opportunities.

Monefit recognized these gaps and designed SmartSaver to fill them. It combines the advantages of investment products – higher returns – with the safety and flexibility of savings products. The goal? To help individuals worldwide achieve their financial aspirations swiftly.

Who Should Consider SmartSaver

SmartSaver is ideal for individuals with idle money in low-yield bank accounts. It suits a wide range of users, whether you’re an experienced investor looking to diversify your portfolio or a newcomer to investing.

This versatile product caters to various financial goals, from saving for an upcoming vacation or wedding to securing your children’s future or building a retirement nest egg.

Ease of Use

Starting your SmartSaver journey is a breeze. There are no fees, hidden costs, or complex signup processes. You can kickstart your investment with as little as €10, and monthly interest payments ensure your wealth grows steadily.

A Win-Win Proposition

SmartSaver encourages responsible financial habits, offering users a win-win scenario. The actual annual rate (APY) consistently outperforms the advertised 7.25% interest rate.

Access and Liquidity

SmartSaver ensures users can access their funds whenever they need them. No waiting for predefined schedules – withdrawals are processed promptly, with funds available in just 10 business days.

Who Can Participate

SmartSaver is available to residents across all EU countries. Individuals of varying credit profiles can participate, provided they meet the required Know Your Customer (KYC) and Anti-Money Laundering (AML) criteria.

Supporting Financial Liquidity

SmartSaver not only benefits savers but also contributes to supporting the liquidity needs of lending products. This synergy allows for potentially higher returns for credit products.

Your Path to Financial Security

SmartSaver caters to individuals seeking certainty and possessing a lower risk appetite. It’s an attractive option for those aspiring to financial freedom and secure retirement.

What’s Next

Monefit’s SmartSaver has an exciting roadmap ahead. Upcoming features include auto savings, rewards, and expansion into new geographic markets.

Monefit, a part of the Creditstar Group, has been serving millions of customers across 8 European countries since 2006, offering innovative credit products and returning a significant €83 million in interest to date.

While SmartSaver offers an excellent opportunity, it’s essential to note that investments carry inherent risks. Seeking professional advice before depositing funds is advisable.

SmartSaver: Your gateway to smarter savings, greater returns, and financial security. Start your journey today!

Discuss this article / 0 comments