In the ever-evolving world of finance, passive income has become a cornerstone of wealth-building strategies. Peer-to-peer (P2P) lending, a modern approach to investing, allows individuals to earn interest by directly funding loans for borrowers—without the need for traditional banks. With the promise of high returns and the ability to handpick loans, P2P lending has become an appealing alternative investment. This guide will walk you through the essentials of earning money through P2P lending and help you make the most of this growing financial opportunity.

What is Peer-to-Peer (P2P) Lending?

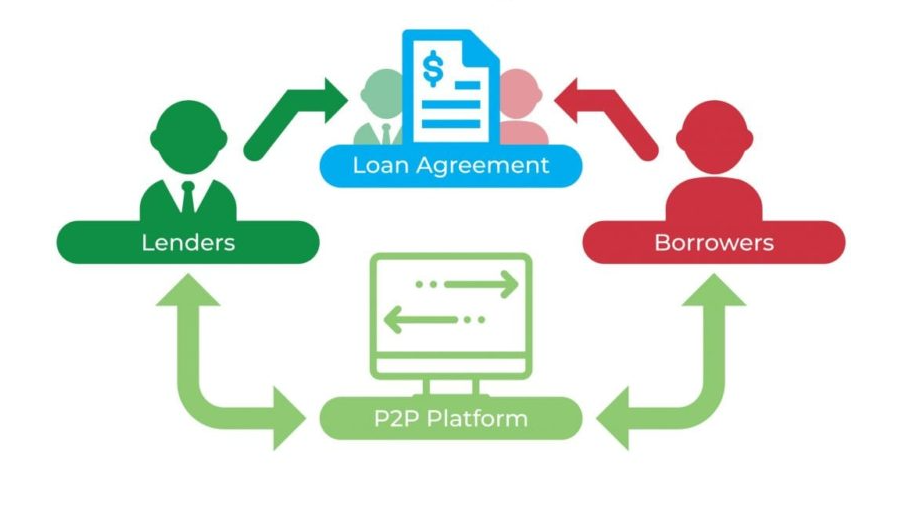

Peer-to-peer lending connects borrowers directly with investors through online platforms, cutting out banks as intermediaries. This model often provides better terms for borrowers and more lucrative returns for investors. Unlike traditional investments, P2P lending offers investors the ability to diversify their portfolio with high-return opportunities while taking on calculated risks.

Why Choose P2P Lending?

- High Returns: P2P lending typically offers annual returns between 5–12%, much higher than savings accounts or traditional fixed-income investments.

- Diversification: It provides a way to move beyond stocks, bonds, and real estate by offering returns uncorrelated with market fluctuations.

- Control Over Investments: Investors can select loans based on factors such as risk level, borrower profiles, and loan purpose, allowing them to align investments with their goals.

How to Get Started with P2P Lending

- Choose the Right Platform

Select a platform that aligns with your goals, such as Monefit, Mintos, or Lendermarket. Look for factors like minimum investments, loan variety, platform fees, and historical returns. - Assess Your Risk Tolerance

Loans are categorized by risk level—low, medium, or high. Lower-risk loans may have modest returns but are safer, while higher-risk loans offer the potential for higher earnings but carry a greater chance of default. - Fund Your Account

Deposit funds into your P2P account. Many platforms allow you to start small, often with as little as €10 per loan. Some even provide auto-reinvestment options to help grow your portfolio. - Select and Fund Loans

Use borrower data like credit scores, income, and loan purpose to choose loans that match your risk appetite. Diversify across multiple loans to reduce the impact of defaults. - Monitor Your Portfolio

Regularly review your investments to track loan performance and missed payments. Adjust your strategy as needed to maximize returns.

Potential Risks in P2P Lending (and How to Mitigate Them)

- Default Risk

Borrowers may fail to repay their loans. Minimize this by diversifying across many loans and avoiding overexposure to high-risk categories. - Platform Risk

Not all P2P platforms are financially stable. Stick to reputable, well-established platforms and avoid concentrating all your funds in one place. - Liquidity Risk

P2P loans are less liquid than other investments. To maintain flexibility, consider loans with shorter durations or keep some funds in more liquid assets.

Advanced Strategies for Maximizing Returns

- Reinvest Earnings

Use compound interest to grow your wealth by reinvesting your returns into new loans. Most platforms offer automatic reinvestment options to simplify this process. - Balance Risk and Reward

While high-risk loans offer higher returns, they should only make up a small portion of your portfolio. Strategic diversification can boost earnings while managing risk. - Utilize Automation Tools

Platforms often provide automated tools to select loans based on your investment criteria, saving you time and reducing decision fatigue.

Common Myths About P2P Lending

Myth: P2P Lending is for High-Risk Investors

Reality: P2P lending offers a range of risk levels, from conservative loans to high-yield options.

Myth: You Need a Large Initial Investment

Reality: Many platforms allow you to start with as little as €10 per loan, making it accessible to beginners.

Myth: It’s Only for Financial Experts

Reality: P2P platforms are designed with user-friendly interfaces that make them easy to navigate, even for first-time investors.

Conclusion

Peer-to-peer lending is an innovative way to earn passive income, diversify your portfolio, and achieve financial goals. By choosing the right platform, understanding the risks, and implementing smart strategies, you can unlock the full potential of P2P lending. Whether you’re just starting out or are an experienced investor, this alternative investment avenue offers the opportunity to achieve higher returns while actively shaping your financial future.

Discuss this article / 0 comments