P2P lending is lending between private individuals, which means that you become a kind of bank and can grant loans yourself. The whole thing works via so-called P2P platforms. On these platforms you are offered numerous loans, in which you can usually invest starting from 10 euros.

These loans offer fixed interest rates over the term of the loan. These interest rates fluctuate between 6% and 20% p.a. depending on the platform and type of loan. Over the past few years, I have been able to easily achieve returns of 11% to 16% with P2P loans. And that’s exactly why this type of cash flow generation is so interesting. You can build up a passive income with very little investment volume without using your invested capital. In addition, you receive repayments almost daily as a result of interest and repayment payments.

If you do not know what P2P loans are and have not yet dealt with the risks then do some research online.

6 reasons why you should use P2P lending as a passive source of income

There are many ways to get passive income. For me, P2P loans are one of the easiest ways to generate additional income and increase my cash flow.

Here are my preferred 6 advantages:

1. The simplicity

Investing in P2P lending is easier than buying a stock. Registering with the P2P platforms is quick and easy. Even authentication with a personal ID can be carried out conveniently online.

Majority of these platforms are modern, clear and very easy to use. In addition, there are more than enough instructions on blogs and YouTube channels that leave little questions unanswered.

Even if very few platforms have a mobile app, you can still invest on every platform from your smartphone, as the websites are all optimized for mobile devices.

After all, if you want to build passive income, it should be easy too!

2. The high interest rates

You want your cash flow source to be as effective and profit-oriented as possible. When you invest, you want to generate as much profit as possible.

P2P loans offer very high interest rates (with the corresponding risk!). With most P2P platforms, you can realistically achieve an interest rate of 11% to 16% per year.

3. The steady return flows

With passive income in particular, you certainly want to have cash flows that reach you regularly or often. With P2P loans, as soon as you have invested in several loans, you have almost daily returns in the form of interest and repayments. You can withdraw these amounts or invest them in new ones.

Therefore, P2P loans are the ideal cash flow optimization.

4. Invest automatically

The goal with passive income is to be “passive”. It should simply not be an active income for you, where you always have something to do.

With P2P loans you invest via so-called auto invest functions, or in short: auto investors. These are little tools that you can use to set your investment preferences. Exactly according to your personal specifications, for example, you will invest in loans in 10 euro steps. In some, you can filter countries as well.

If you want even less work, simply invest in fully automatically managed portfolios. These are called, for example, Invest & Access from Mintos or Lendermarket auto-invest . So you give up any effort.

5. The diversification

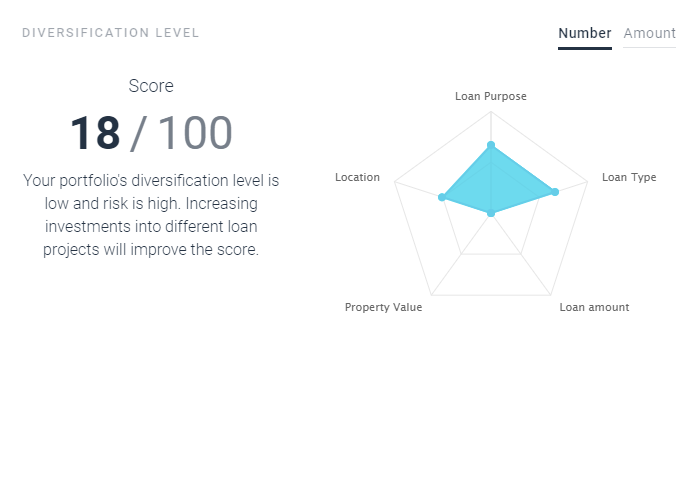

As with any form of investment, diversification should always be the focus. Especially with higher-risk investments, such as P2P loans, you should spread your money carefully. Make sure to spread the investments in different loans. Here is an example, where I didn’t diversify properly and the platform warns me on the difersification level being low.

You can now invest in a variety of loan types. This also includes loans with real security (e.g. cars, real estate) or business loans. The market and the range are growing continuously.

I invest in 8 different types of credit on a dozen or more P2P platforms, and I have loans from a good 30 countries in my portfolio.

6. The buyback guarantee

The buyback guarantee is a promise – no guarantee that the lender will buy you back loans if the borrower has not paid his loan after 30 or 60 days (depending on the platform). You will even be reimbursed the interest you have accrued to date.

The lender buys the loan from you and then starts the collection processes.

The big advantage for you is that you don’t have to wait for these lengthy processes. You get your money in advance, regardless of whether the collection process is successful or not. For the lender this is a mixed calculation and for you a perfect shortcut to get your money back quickly.

The buyback guarantee is not a guarantee ! The lender can only afford this as long as he is liquid and his mixed calculation works. Please inform yourself fully about the buyback guarantee before you start investing!

Discuss this article / 0 comments