When it comes to investing, the topic of risk often takes center stage. In a recent survey focused on investment attitudes, a significant portion of respondents expressed apprehension about investing due to perceived risks. However, the level of risk in P2P investing, much like other investment ventures, is influenced by the choices investors make.

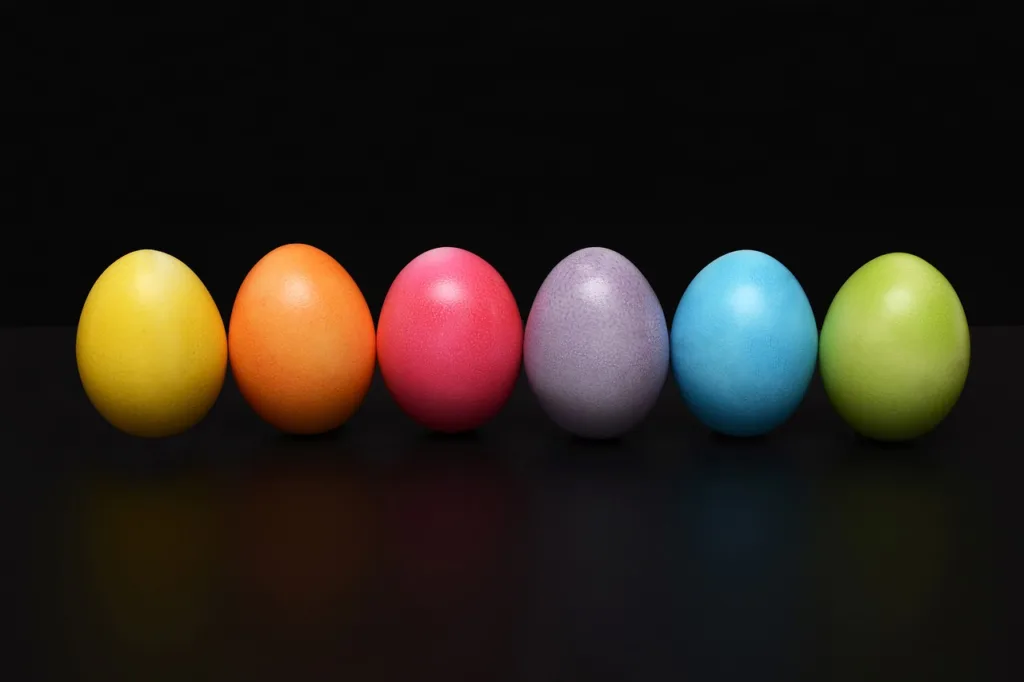

Just as in life where choosing between playing tennis or skydiving entails different levels of risk and reward, P2P investors face similar considerations. One effective strategy to manage risk in P2P investing is to avoid putting all your eggs in one basket.

In this analogy, the “basket” represents an investment vehicle, such as a P2P lending platform, while the “eggs” symbolize your invested funds. Placing all your funds into a single investment exposes you to the risk of loss if that investment underperforms or fails.

To mitigate this risk, investors can diversify their P2P investment portfolio across different platforms, loans, and risk levels. This diversification strategy allows investors to spread risk evenly across their portfolio, reducing their dependency on the success of any single investment.

Just as investors have the option to choose between “safe” and “risky” baskets in traditional investing, P2P investors can select loans with varying risk profiles. While less volatile loans may offer lower returns, higher-risk loans have the potential for greater returns but also come with increased risk of loss.

Furthermore, investors must consider the geographical markets in which they invest. While markets in regions like Japan and Asia may offer higher returns, they also carry greater risk compared to more stable markets like in the EU.

By adopting a balanced approach to P2P investing, investors can construct a diversified portfolio that includes both high and low-risk investments. This diversified approach spreads risk more evenly across the portfolio, enhancing the investor’s ability to weather market fluctuations and achieve their financial goals.

In essence, diversification is the cornerstone of risk management in P2P investing. By spreading investments across various platforms, loan types, and geographical markets, investors can minimize the impact of potential losses and strive for long-term financial success in the dynamic world of P2P lending.

Discuss this article / 0 comments