Peerberry is a peer-to-peer lending platform that connects investors with borrowers seeking loans. It was founded in 2017 and has quickly gained popularity among investors for its reliable performance and user-friendly interface.

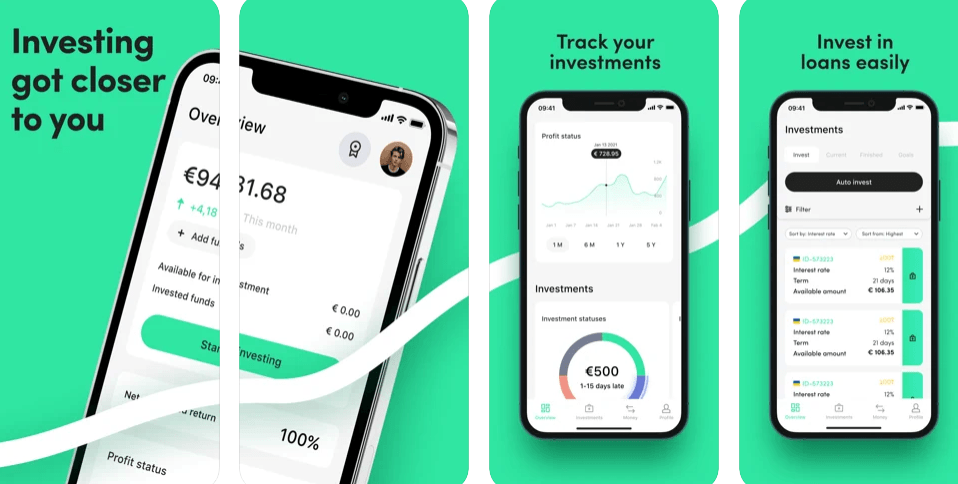

User-Friendly Platform

One of the standout features of Peerberry is its user-friendly platform. The marketplace is designed with a clean and intuitive interface, making it easy for investors to navigate and find investment opportunities. The investment dashboard provides a clear overview of the available loans, their interest rates, and the remaining term, making it convenient for investors to select and invest in loans that align with their investment goals.

Diversified Investment Opportunities

Peerberry offers a wide range of investment opportunities, allowing investors to diversify their portfolio. Investors can choose from various types of loans, including short-term loans, installment loans, and real-estate loans, from different loan originators across Europe. This diversity allows investors to spread their risk and minimize the impact of any potential defaults.

Auto-Invest Feature

Peerberry offers an auto-invest feature, which allows investors to automate their investments. This feature lets investors set specific investment criteria, such as interest rate, loan term, and loan originator, and the platform will automatically invest in loans that meet those criteria on their behalf. This can save time for investors and ensure that their funds are efficiently invested according to their preferences.

Buyback Guarantee

Peerberry offers a buyback guarantee on many of its loans, which adds an additional layer of security for investors. Under the buyback guarantee, if a borrower defaults on their loan, the loan originator will repurchase the loan from the investor, along with any accrued interest. This helps to mitigate the risk of default and provides peace of mind to investors.

Transparency and Reporting

Peerberry provides transparent and detailed reporting to investors. Investors can access comprehensive information about their investments, including loan details, repayments, and interest earned, through their investment dashboard. The platform also offers regular updates and reports on the performance of the loans and loan originators, allowing investors to stay informed about their investments’ progress.

Reliable Performance

Peerberry has a track record of reliable performance, with a low rate of default and a high rate of successful repayments. The platform conducts due diligence on loan originators and carefully selects loan originators based on their financial stability and track record. This helps to reduce the risk of default and ensures that investors have access to reliable investment opportunities.

Customer Support

Peerberry offers responsive customer support to investors. The platform provides multiple channels for investors to reach out for assistance, including email and a chat feature on the platform. The customer support team is known for being prompt and helpful in addressing investor inquiries and concerns.

Conclusion

In conclusion, Peerberry is a reliable and user-friendly investment platform that offers a diverse range of investment opportunities with a buyback guarantee and transparent reporting. The platform’s auto-invest feature and responsive customer support make it convenient for investors to manage their investments effectively. Peerberry’s reliable performance and commitment to transparency make it a trustworthy option for investors seeking to diversify their portfolio through peer-to-peer lending. However, as with any investment, it is essential to carefully review the risks and conduct due diligence before investing in Peerberry or any other investment platform.

Discuss this article / 0 comments