A classic among the standard questions is how do I invest in P2P lending? How do you invest properly? How can I invest my money without making a mistake? And of course also questions such as: should I buy shares or put my money in a bank account?

This is exactly what my article ” Investing Correctly in P2P Lending ” is about . What do you have to pay attention to? What kind of P2P investment strategies are out there and what is the current experience?

Important questions before the first P2P investment

Before you invest, there are questions you should answer for yourself. It does not always make the most sense to invest or invest the money saved directly. Investing money is good and right, but it should be done carefully and thought out. Check out my 4 questions before investing.

It is always important that you invest in yourself and, if applicable, your family, before investing in the stock market or investing in P2P loans.

In addition, you should never invest money that you will need in the near future. Every form of investment, be it the stock market, fixed-term deposits or P2P loans, have various terms to which your capital could be tied. If the stock goes down, you’ll want to wait. If you have put your money into the fixed-term deposit for 5 years, you will not get it before the 5 years have expired.

Therefore, clarify your general conditions and think about an investment strategy!

How does investing on a P2P platform work?

You have dealt with my 4 questions and everything is clarified? You know what P2P lending is and know the risk ? Then getting started with P2P lending in 2021 is pretty easy!

You can become a P2P investor in the following steps:

Understanding P2P Lending

Make sure you understand the concept of P2P lending. Nothing is worse than investing in things that you have not or only partially understood. The following points will help you:

- What are P2P lending?

- About the diversity of the types of credit information

- Know the risks!

- What is a P2P platform?

- If you really want to learn everything about P2P loans, the best thing to do is to buy some basic books

Find a P2P platform

Think carefully about which provider you start with. When making a P2P investment, the P2P platform is crucial. What kind of experiences are there? Does the provider fit your strategy?

Here you will find a little help on how to find the right P2P platform . I also have more information for you here about the functionality and advantages of P2P platforms.

Registration

Registration is very easy. In addition to your name and address, most of the platforms also need a photo of your ID or passport. You can do this conveniently using your smartphone and upload it.

Making a deposit

The deposit can also be made quickly with SEPA. The transfer to the P2P platform is also very quick. Here you can find more information about SEPA transfers to other EU countries.

Investing manually or with Auto-Invest

Most investors invest with the Auto-Invest offers. Lendermarket in particular has an excellent auto-invest function.

Managing return flows (reinvesting or withdrawing funds )

You should check your investments every now and then and think about what to do with the repayments. Would you like to reinvest this or would you prefer to cash it out?

You see, it’s actually not that complicated. As with so many things in life, the hardest part is getting started. Once you’ve got started with P2P lending and decided on a P2P platform, the remaining steps will be much easier.

How to get your first P2P loan

Have you understood the “P2P loans” asset class and have you already chosen a P2P platform? Perfect.

Then let’s move on. You have probably already registered and are now an investor on a P2P platform? Congratulations🎉

Then only the deposit is missing. Without money – nothing going on. You can find out how the transfers work and which alternatives you have when making a deposit.

As soon as your money is available, you will receive an email. As a rule, the money is already credited on the next working day.

When your funds are available, you can invest in the loans manually or using the auto-invest function.

Manual investing

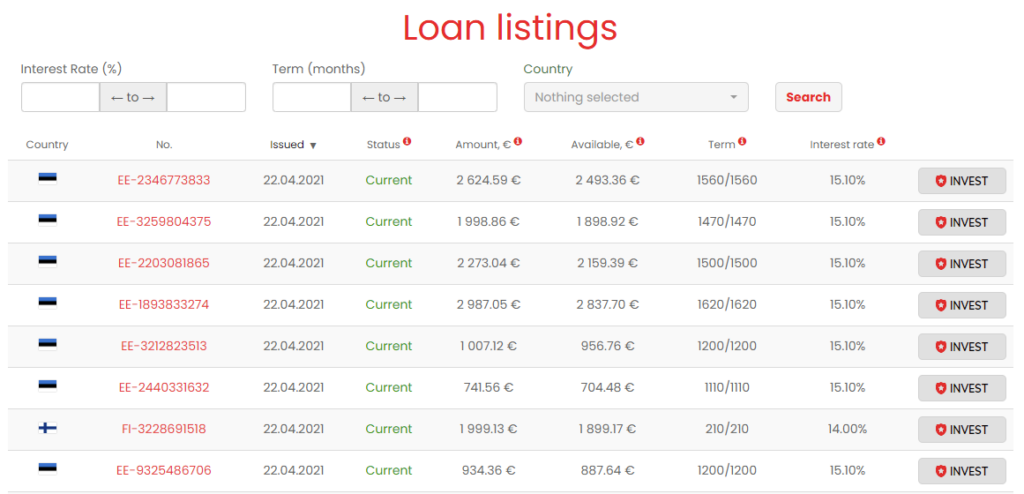

You can invest manually on most platforms. Manual means that you can select each loan individually. With each investment decision, you can also invest different amounts.

Manual investing in P2P loans sounds interesting, but on many platforms it is simply too time-consuming.

Especially on marketplaces where you invest very widely in consumer loans, you usually start with 10 euros per loan.

As an investor, you can get 50, 100 or more loans very quickly. It takes a lot of time to select 100 loans individually. In practice, the effort is not worth it.

Most lenders don’t give out a lot of information about the loans, so you can’t get a clear picture of the borrower at all. This eliminates an important tool for loan selection and many investors then ask themselves: Why invest manually at all?

Invest with the auto-invest function

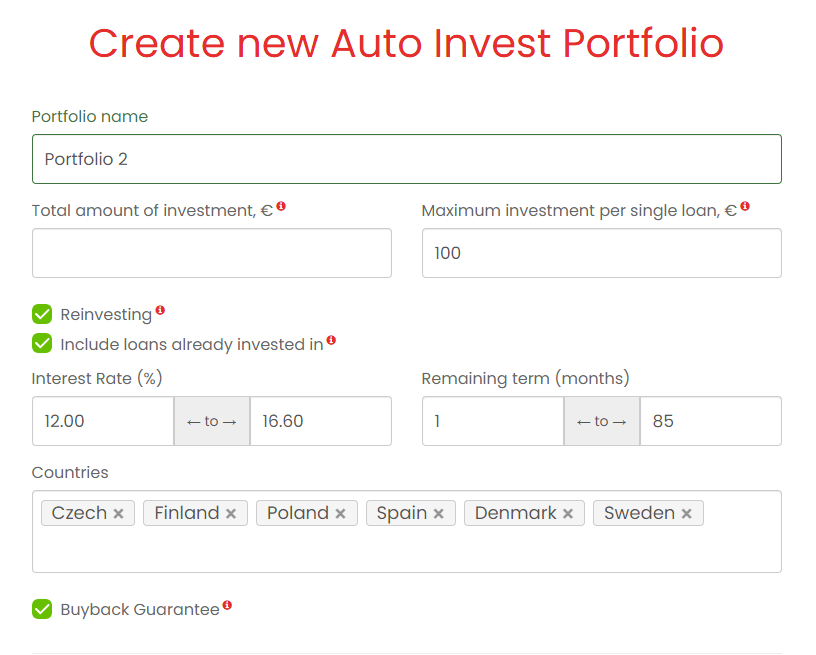

All platforms offer an auto-invest function. This is also called an auto investor or portfolio builder. No matter what these tools are called, they always work the same way.

You simply enter your wishes and framework parameters in the tool and click on save. The auto-invest function now invests free capital according to your specifications. If a loan matches your selection, investments are made. If the loan does not fit, then no investment is made.

The “Reinvesting” function is particularly helpful. This means that all interest and repayments are automatically reinvested in new loans. Perfect for anyone who wants passive investing.

Important and common questions when investing in P2P lending

It all depends on the types of loans you have invested in.

If you have invested in short-term consumer loans, you will have the first interest and repayments within a few days.

If you invest in loans that are paid in monthly installments, you always have to wait for the respective installments.

In addition, you always have to note that a borrower does not pay and you may have to wait for the buyback guarantee.

High. For the past two years, double-digit returns have not been an issue. But be careful! Don’t let the returns blind you. Invest only small amounts as an addition to your portfolio. This is very important, especially for building solid old-age provision . The wider the tower, the more stable it stays! And please always pay attention to the high risks, nobody gives away money!

The risks are diverse, so you should definitely find out about the risk of P2P lending .

Yes and no. Most platforms are free of charge. There are no costs for you as an investor. But there are providers who, for example, charge a fee when selling loans or withdrawing money.

You should always discuss the taxation of interest income with a trusted tax advisor. There are P2P platforms on which the tax is deducted directly from interest income, a certificate of residence can help you here. Other providers do without it and pay you 100% of the interest income, so that you can take over the taxation yourself.

Discuss this article / 0 comments