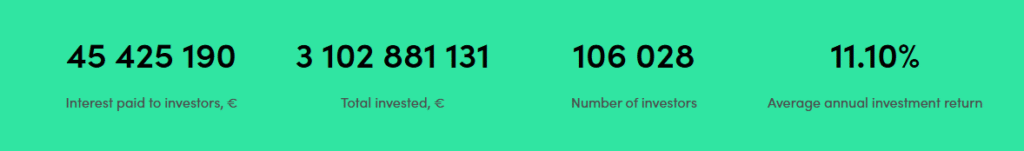

PeerBerry, launched in 2017 by the Aventus Group, has facilitated over €2.7–3 billion in funded loans, with more than 87,000 investors across Europe. It offers loan types including short-term personal loans, business and real estate development financing, typically delivering 9–12% annual returns (average around 11%).

✅ Key Strengths

• Competitive Returns & Accessibility

Offers attractive interest (often 11–12%) with a low entry barrier—ideal for small-scale or beginner investors.

• Strong Buyback Guarantee

Most loans include a 60-day buyback guarantee, ensuring principal plus interest is repaid in case a borrower defaults beyond 60 days.

• Fast, Transparent Withdrawals

Withdrawals typically process in 1–2 business days, with no investor fees. While a secondary market is absent, short terms help maintain liquidity for most investors.

• User-Friendly Platform & Auto-Invest

The interface is clean and intuitive—with language support across several European languages—and includes a flexible Auto Invest feature to automate loan selection based on predefined criteria.

• Crisis-Resilience & Track Record

PeerBerry has proven robust during crises (e.g., the Ukraine war), managing to repay all war-affected loans via its group guarantee. Performance remained stable even under stress.

• Responsive Customer Support

Many users report helpful and efficient support via email, chat, or Telegram.

⚠️ Key Drawbacks

• No Secondary Market

Loans must be held until maturity—meaning limited control and poorer liquidity for longer-term instruments.

• Cash Drag Periods

High demand can occasionally exhaust loan availability (“cash drag”), leaving funds idle and reducing potential returns. Auto-invest may struggle during peak demand.

• No Regulatory License

PeerBerry operates without an official financial market license such as the ECSP or national FCA license. While governance appears solid, this may concern highly risk-averse investors.

• Delay in Reported Returns

Some investors note delayed loan repayments not always reflected promptly in dashboard balances or reported returns.

🗣️ Community Insights (Reddit Highlights)

“Over a year in PeerBerry and no issues.”

“No problem with Robotcash. Overall, I will never put a penny again on P2P …though if you do, I’d recommend PeerBerry.”Other users acknowledged delays tied to loans originated in Ukraine and Russia, yet noted full repayment of balances—even after years—reflecting PeerBerry’s reliability in crisis.

“P2P lending…not a safe investment… could lose 100% of your loan. Limit exposure to 5–10% of your portfolio.”

PeerBerry returns are seen as moderate compared to platforms like Mintos or Esketit, but perceived as more stable.📊 Platform Comparison Snapshot

Feature PeerBerry Annual Return ~9–12% (average 11%) Minimum Investment €10 Fee to Investor None (platform earns from originators) Buyback Guarantee Yes (after 60 days) Secondary Market ❌ None Liquidity Moderate (mostly short-term loans) Auto-Invest ✅ Supported Regulation ❌ No specific license Customer Support Good ratings, fast responses ✅ Who Should Consider PeerBerry?

- Short-term income investors seeking stable returns with quick capital turnover.

- Small-scale or beginner investors, thanks to low minimum entry and ease of automation.

- Investors looking for moderate risk, preferring consistent outcomes over maximal yield.

- Those comfortable with illiquid loans, holding until maturity without secondary-market exit.

🚫 Who Might Not Fit Well?

- Investors needing full liquidity or wanting early sell capability.

- Risk-averse individuals prioritizing regulatory oversight and investor protection.

- Users expecting up-to-the-minute return reporting—PeerBerry sometimes lags on overdue loans.

🔚 Final Verdict

With a long track record, high average yields around 11%, and strong default protection mechanisms, PeerBerry is a solid platform for moderate-risk P2P investing.

While liquidity and regulatory status are limitations—and cash drag can occasionally affect performance—its user interface, reliable support, and loan variety make it an attractive option for many retail investors.

For higher liquidity needs or a broader feature set (like secondary markets), platforms such as Monefit, Esketit, or Robocash may be worth considering.

Discuss this article / 0 comments