As peer-to-peer (P2P) investing continues to gain traction in Europe, platforms like Lendermarket.com are providing retail investors with more ways to earn attractive returns by funding consumer loans. Backed by a user-friendly interface and competitive interest rates, Lendermarket is becoming an increasingly popular choice among both new and experienced investors.

In this review, we’ll cover everything you need to know about Lendermarket—including how it works, its key features, pros and cons, and whether it’s the right platform for your investment goals.

What is Lendermarket?

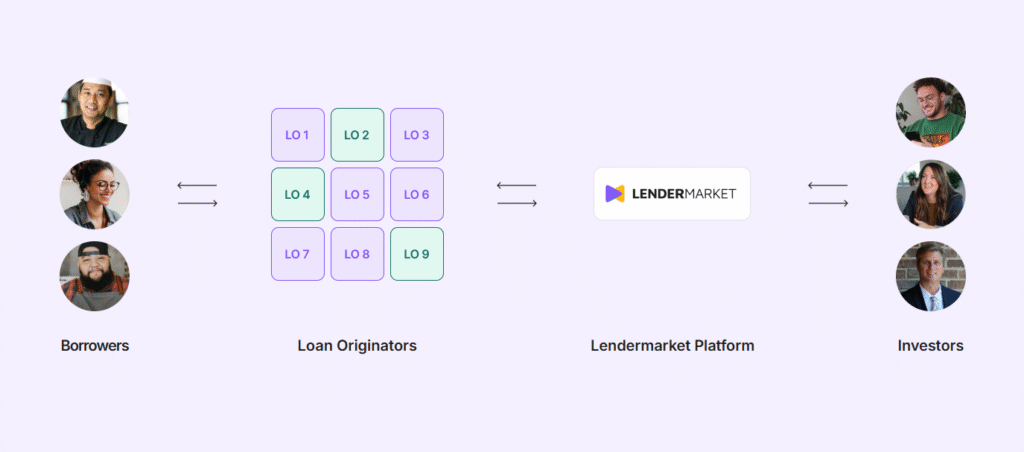

Lendermarket is a Dublin-based peer-to-peer lending platform launched in 2019. It allows investors to earn passive income by funding loans originated by external loan originators, primarily from emerging and mid-tier European markets. The loans are typically short- to medium-term consumer loans, and most come with a buyback guarantee, which helps mitigate investor risk.

While Lendermarket started by featuring loans primarily from Creditstar Group, it has since expanded its offerings and continues to grow its network of trusted loan originators.

How Does It Work?

Lendermarket connects investors directly to pre-funded loans issued by partner loan originators. As an investor, you can:

- Sign up and verify your identity.

- Deposit funds via SEPA transfer and bank cards

- Manually select loans or set up an Auto Invest portfolio.

- Earn interest as borrowers repay their loans (monthly or at term-end).

- Withdraw your funds or reinvest them.

Minimum investment per loan is just €10, making it accessible for investors of all levels.

Key Features

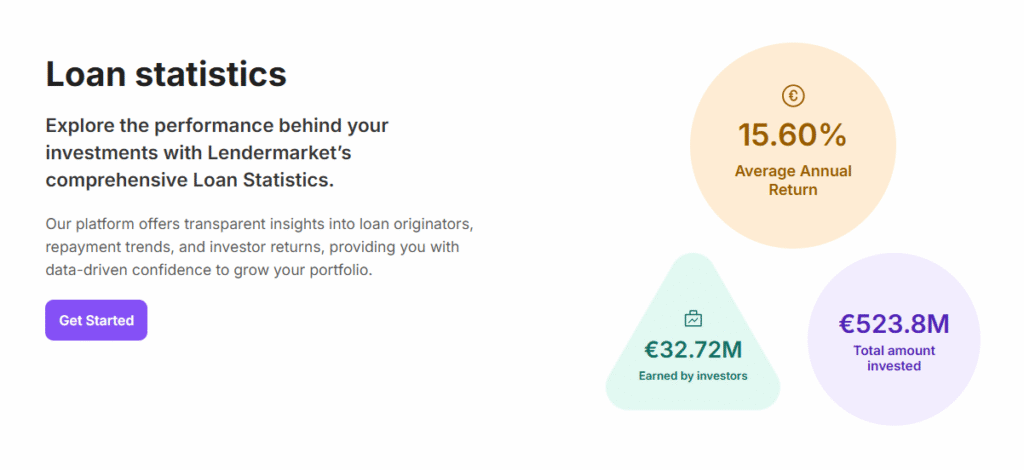

1. Attractive Returns

Lendermarket offers annual returns of up to 16%, depending on the loan originator and loan duration. While high returns always carry risk, Lendermarket’s rates are among the most competitive in the P2P lending space.

2. Buyback Guarantee

Most loans come with a buyback guarantee, meaning if a borrower delays payment for more than 60 days, the loan originator repurchases the loan and pays accrued interest. This adds a layer of protection for investors, though it’s important to remember that the guarantee is only as reliable as the originator backing it.

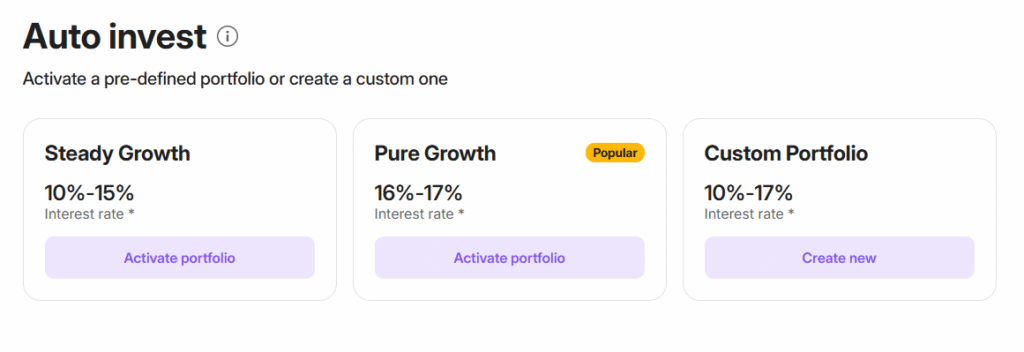

3. Auto Invest

Lendermarket’s Auto Invest tool allows users to create custom investment strategies based on loan term, interest rate, originator, and more. This is especially useful for investors looking to automate their income stream.

4. No Fees for Investors

Lendermarket does not charge account management, deposit, or withdrawal fees. This keeps more of your returns in your pocket.

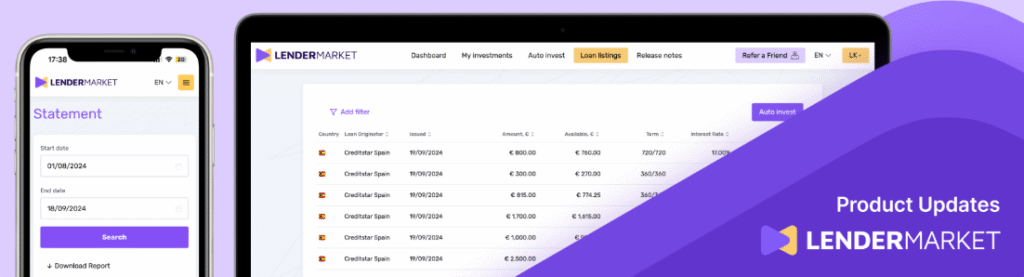

5. Transparent Reporting

The platform offers clean, downloadable reports and an intuitive dashboard so you can track your performance in real time.

Pros and Cons

✅ Pros:

- High potential returns (up to 16%)

- Buyback guarantee on most loans

- Low minimum investment (€10 per loan)

- Auto Invest functionality

- No investor fees

- Modern, user-friendly platform

❌ Cons:

- Limited loan originators compared to larger P2P platforms

- No secondary market (as of now)

- Exposure to originator risk (especially if buyback fails)

- Not regulated under EU crowdfunding rules (yet)

Is Lendermarket Safe?

Lendermarket performs due diligence when selecting its loan originators, but investors should remember that P2P lending is not risk-free. The main risks are:

- Loan default: mitigated by the buyback guarantee

- Originator failure: if the originator cannot honor the buyback

- Platform risk: if Lendermarket itself faces financial or operational issues

That said, the platform has been operating since 2019, and its key loan originator, Creditstar Group, is a well-established lending business with over a decade of experience.

Who Should Use Lendermarket?

Lendermarket is a solid choice for:

- Investors seeking high-yield passive income

- Those who want diversified exposure to consumer lending in emerging markets

- People who prefer short- to mid-term investments

- Investors comfortable with moderate risk

It may not be ideal for ultra-conservative investors or those who need instant liquidity, as there is currently no secondary market for selling loans before maturity.

Final Verdict

Lendermarket.com offers a compelling value proposition for retail investors looking to boost their passive income through P2P lending. With high potential returns, a straightforward interface, and features like buyback guarantees and Auto Invest, it stands out as a competitive option in the European P2P landscape.

However, like any investment, it comes with risks—mainly tied to loan originators and platform regulation. It’s best used as part of a diversified portfolio, especially for investors willing to accept some risk in exchange for higher potential rewards.

Overall Rating: 4.3 / 5

Disclaimer: Investing in P2P loans carries risk, including loss of capital. Past performance does not guarantee future returns. Always do your own research or consult a financial advisor before investing.

Discuss this article / 0 comments