Bondora is one of a number of companies that have focused on lending through the Internet in recent years. In particular, the fact that individuals can play the role of the investor and thus secure an attractive return in times of low interest rates plays a role. It was important to us to take a closer look at the quality of this offer.

The conditions

Of course, many sites are already interested in terms and conditions associated with Bondora credit. In contrast to a traditional bank, however, it can not be said here which interest rate the borrower can expect. This is because too many individual factors influence the situation at the end of the day. On the one hand, the creditworthiness of the borrower determines which costs ultimately affect the individual customer. If an applicant does not succeed in clearly proving his/her own creditworthiness, then from the perspective of the investor there is a higher risk of default. It is obvious that the lenders side likes to pay for this risk. Thus, the interest due on the loan increases.

On the other hand, the focus is on the special form of flexibility associated with the Bondora offer. In practice, the wide range of different loan amounts to the benefits on the part of customers. So it is already possible from an amount of only 1,000 euros to take advantage of the offer. This sum is always necessary. Likewise, borrowers have the opportunity to demand a much higher five-digit sum. This in turn is sufficient to finance even larger dreams and desires, as they would not have been possible on the basis of their own capital. The bottom line is that it addresses a broad target group, which in any case counts among the advantages of the company,

Investors also attach great importance to Bondora being informed about the nature of their investment. As with comparable platforms on the Web, the presentation of the purpose of the investment is therefore the focus first. The sooner you succeed in convincing potential investors of your own idea, the sooner you will be able to claim the desired loan amount. In particular, their assessment of the risk plays an important role. The interest payments that are eligible for the loan are now grossly priced by the borrower. This raises the question of whether a good balance between risk and return can be achieved, which ultimately helps investors decide to invest. If, in view of the financial risk, the return is too low.

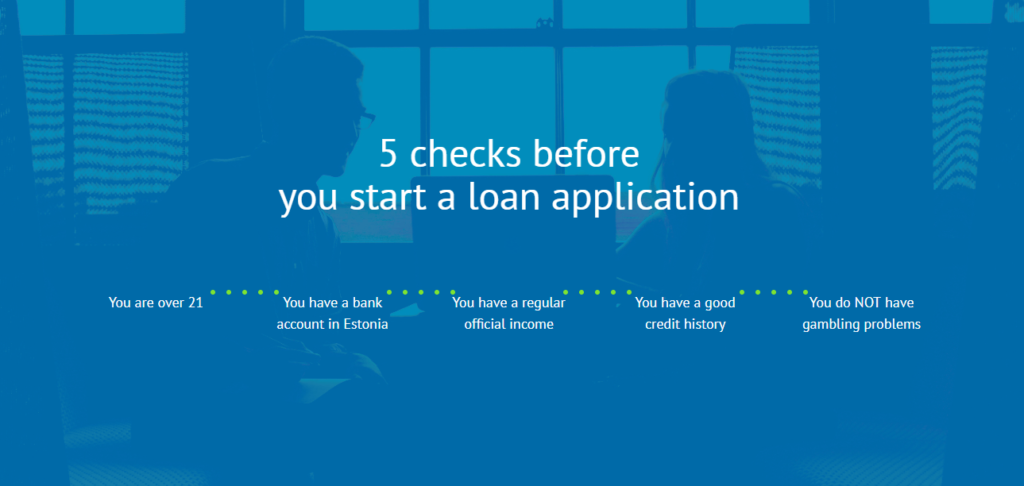

The way to Bondora credit

People who want to receive a Bondora loan, experience a clear process. Directly on the start page of the company it is possible to enter the personal data. As a result, they become the basis for the subsequent search for investors. A credit inquiry can be particularly interesting if, for example, it goes hand in hand with the desire to start a business. Often, investors are already convinced by a solid business idea and are then happy to support them with their own capital. On the other hand, it increases the likelihood in their eyes that all installments of the loan can be paid properly and thereby make a good deal for them.

If your own request has been designed and provided with all important data, it goes online on the platform. Your own personality remains completely protected in this context. Finally, it is only possible for registered members of Bondora to gain insight into current loan projects. It now decides whether enough investors can be found within the given deadline to handle the entire loan amount.

As investors attach great importance to good diversification, it is usually multiple lenders who collectively raise capital for a loan. If it is not possible to raise enough capital within the deadline, the project will automatically disappear from the platform. However, it would be possible to offer this once again with improved conditions and to hope for a better result.

The momentum that exists on the side of Bondora stems especially from the influence of supply and demand. These two parameters are ultimately responsible for the current prices of financing. If there are many investors who would like to invest money in a personal loan, but comparatively few projects, then borrowers have the luck on their side. Even at low interest rates, you have the opportunity to obtain and benefit from financing. On the other hand, if there are many projects to be lent, but the number of investors is tight, the cost of loans will be much higher. In the end, therefore, the right timing determines whether it is finally possible to achieve a good relationship between price and performance.

For whom is the Bondora loan suitable?

Experience has shown that every loan seeker has the opportunity to get financing from Bondora. However, some target groups play a particularly important role from the company’s point of view. On the one hand, these are freelancers, self-employed and entrepreneurs. They often find it difficult to get a cheap loan because of the lack of fixed income in traditional banks. However, as this is very closely related to the intended use on the platform, a rough estimate is possible as to whether repayment of the money will be possible in the near future. Therefore, this target group often finds investors who see the potential behind the use of money and see it as an opportunity to earn a return on their own.

Bondora from the perspective of the investor

But not only the view of the borrowers interested in looking at the platform Bondora. Especially due to the currently generally low interest rates, there are immediately many people who are looking for an investment opportunity. In the meantime, traditional investments are no longer able to generate a truly significant return that meets the requirements. Investing in personal loans, as is possible at Bondora, can also be a good solution from a financial point of view. Depending on the risk class, it is possible to achieve returns of more than nine percent. On average, it is even more than five percent worth of value per year, to which not even the majority of shares is capable. So it is hardly surprising that Bondora now advertises itself,

Furthermore, it is the secure administration that supports investors on their way. Together with a senior bank, Bondora has been able to regulate the flow of money for about ten years. For this reason, investors can be sure that there are no problems with the management of the money. Meanwhile, there is no denying the risk of default. But even in this case, this does not have to mean any setback for your own investment. Because the costs incurred, for example, for a debt collection process, are not transferred to the investors of the projects.

Furthermore, it is the parameter of diversification that plays a major role in a Bondora investment. Already with medium investment amounts, the customers of the site get the chance to design their own portfolio. So it is possible to split the available amount on several plants. This offers the opportunity to be less dependent on the development of a single project. Rather, it is now possible to benefit holistically from your own investment and to benefit from it. At the same time, the risk can be regulated much better in this way, as it is related to your own investment.

From different perspectives, there are advantages for investors who want to invest their money on Bondora. In a first step, it is important to reconcile the risk of the selected projects with your own requirements. Of course, it is not possible to combine an incredibly safe deposit with a maximum return as these two factors are in any case conditional. A targeted selection, however, helps to meet your own expectations with a high probability. The same applies to the term with which the money is finally to be invested. In line with their own expectations, projects with a repayment period of just 12 months are just as possible as an investment over five or more years. Not least, one’s own expectations

Conclusion and rating

Finally, the look on Bondora shows what great added value can be offered for both sides of the business. On the one hand are the borrowers who get an alternative option to lend. From a financial point of view, too, Bondora cuts a fine figure.

On the other hand, Bondora lenders also benefit. In many cases, personal loans are a very useful addition to one’s own investment and allow a high degree of diversification. The expected return of more than five percent on average also shows the opportunities associated with taking out the loan. So, from the perspective of the investor, the bottom line is that it is worth recognizing the platform’s opportunities and making use of it during this time of low interest rates.

Discuss this article / 0 comments